UK inflation rates: Why and how does the recent drop impact you?

- Megan Wells

- Feb 17

- 4 min read

Updated: Apr 8

Contents

Introduction

Key drivers behind the drop

Impact on consumers and the economy

Impact on students

The future

Introduction

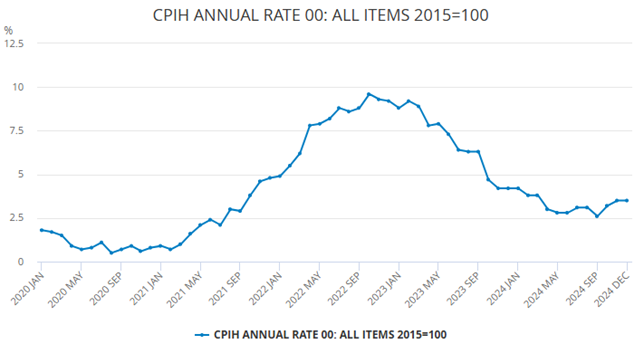

UK inflation rates took an unexpected turn as they dropped to 2.5% in December 2024. They fell from 2.6% in November, a significant drop after the average inflation rate was 8% in 2022. This was due to the aftermath of the Covid-19 pandemic, where we saw inflation rates hit the highest it has been since 1981. This unforeseen drop gives some respite to the Chancellor Rachel Reeves and paves the way for the Bank of England to cut interest rates. But what has contributed to this drop in inflation?

Key drivers behind the drop

The Office of National Statistics (ONS) have said one of the biggest drivers of this inflation drop was the change in hotel and restaurant prices, as shown on the Figure 1.

Closely following change in clothing and footwear, benefiting general consumers, and then the change in alcohol and tobacco prices.

This is due to cigarette tax being lower this year than last year, slightly reducing inflation. These are only a small part of the overall consumer basket. Another key driver behind the drop refers to government borrowing and fiscal pressure. Dr Steve Nolan, Senior Economics Lecturer at Liverpool John Moores University explained that there has been an increase in the cost of government borrowing. He said: “When the interest rate goes up, there is less money we have for spending. To keep to our fiscal rules, the Chancellor is under pressure to either cut public spending, which is unpopular, or raise taxes, which she has really promised not to do.” In simpler terms, if there is less government spending in the economy, demand decreases which contributes to an inflation reduction. Furthermore, a more careful fiscal approach helps slow economic demand and consumer spending.

Impact on consumers and the economy

Inflation is still patently higher than it was before the pandemic, as shown in Figure 2, however this small decline will have an impact on consumers and businesses.

Consumers will feel slightly less pressure on everyday costs. For example, food, fuel, and energy prices, which have previously been key drivers to rising living costs, will become more stable. Consumers and businesses may experience less financial strain leading to more disposable income.

Economists and experts have stated that they were not expecting this drop, creating doubt about what could happen in the future. However, this reduction may provide less uncertainty for consumers, which could increase spending and stimulate economic activity.

The Bank of England are expected to cut interest rates four times this year, however with economists being uncertain about future inflation rates this cannot be explicit to happen. However, it is expected the Bank of England still cuts tax in February, benefitting people with mortgages or debt.

Impact on students

This inflation drop won’t just impact general consumers, businesses or people with mortgages, students will be impacted also.

Like other consumers and businesses, students will experience slightly lower living costs. The cost of goods and services will generally become more stable, meaning everyday living costs will become more affordable, specifically transportation which is a huge financial burden for students either travelling home or commuting.

This inflation drop will hopefully reduce the pressure students face with their finances.

A future possibility for students is lower (or more stable) tuition fees. This inflation drop could signal that future possible fee increases should become stable. However, this is not a direct impact that could come into effect any time soon, and experts have said we could see an increase in inflation rates soon.

If general prices of everyday expenses do stabilise or decrease slightly, students may have more disposable income. Having the option to spend their money on social and leisure activities could help improve quality of life, reduce financial stress and help local businesses who would benefit from this.

However, the drop may negatively impact students if it is part of overall slow economic growth. The government could reduce financial support like loans they receive and students that rely on these may struggle with their finances.

The future

The Office for Budget Responsibility (OBR) has stated they are expecting inflation to average at 2.6% in 2026. OBR said: “Falling energy prices brought CPI inflation down from 10.1 per cent in 2022-23 to 5.7 per cent in 2023-24. But the decline was slower than expected as inflation was 1.5 percentage points higher in 2023-24 than in our March 2023 forecast. Inflation continued to fall after the final quarter of 2023-24, reaching its 2 per cent target in May 2024.” (OBR, 2024) This was published in October alongside the Autumn Budget; therefore, many factors could change these predictions. The Chancellor has confirmed the Spring forecast “mini budget” will take place on 26th March; however, Reeves faces a perhaps uneasy wait for the OBR’s next forecast for the public finances.

References

Office for Budget Responsibility (2024) Forecast evaluation report – October 2024 [online] Available at: Forecast evaluation report – October 2024 - Office for Budget Responsibility [Accessed: 18/01/2025]

Comments